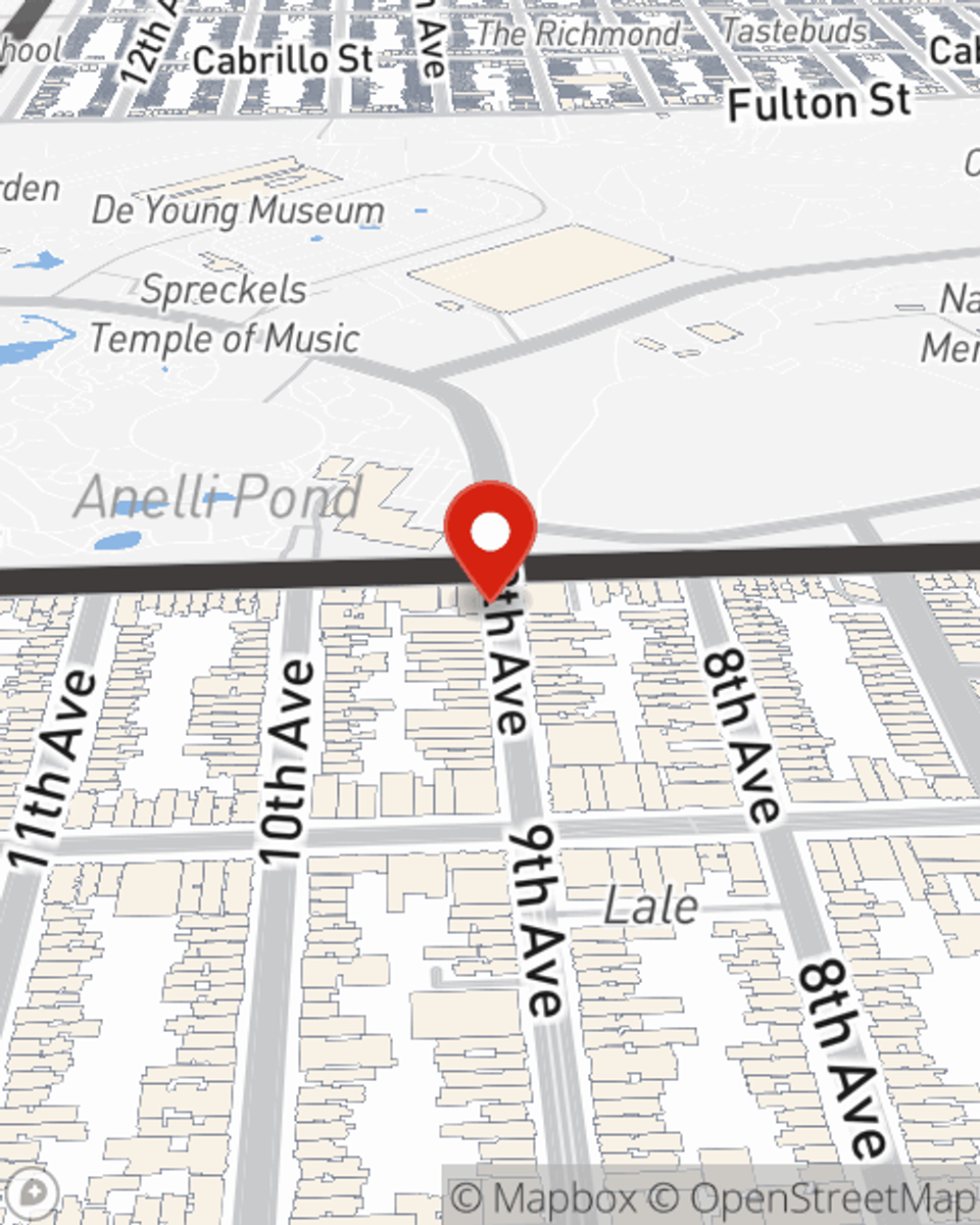

Condo Insurance in and around San Francisco

Townhome owners of San Francisco, State Farm has you covered.

State Farm can help you with condo insurance

Home Is Where Your Heart Is

When you think of "home", your condo is first to come to mind. That's your haven, where you have made and are still making memories with the ones you love. It doesn't matter what you're doing - relaxing, taking it easy, unwinding - your condo is your space.

Townhome owners of San Francisco, State Farm has you covered.

State Farm can help you with condo insurance

Protect Your Condo With Insurance From State Farm

We understand. That's why State Farm offers wonderful Condo Unitowners Insurance that can help protect both your unit and the personal property inside. Agent Christie Kennett is here to help you understand your options - including benefits, savings, bundling - helping you create a customizable plan that works for you.

Insuring your condo with State Farm can be the right thing to do for your home, your loved ones, and your belongings. Visit Christie Kennett's office today to see how you can meet your needs with Condo Unitowners Insurance.

Have More Questions About Condo Unitowners Insurance?

Call Christie at (415) 661-3651 or visit our FAQ page.

Simple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

Christie Kennett

State Farm® Insurance AgentSimple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.